Real Exam Questions and Answers as experienced in Test Center

CGAP Braindumps with 100% Guaranteed Actual Questions | https:alphernet.com.au

CGAP student - Certified Government Auditing Professional (IIA-CGAP) Updated: 2024 | ||||||||

| Pass4sure CGAP exam braindumps with braindump questions and practice test. | ||||||||

|

||||||||

|

||||||||

|

Exam Code: CGAP Certified Government Auditing Professional (IIA-CGAP) student January 2024 by Killexams.com team | ||||||||

CGAP Certified Government Auditing Professional (IIA-CGAP) Certified Government Auditing Professional® (CGAP®) exam Syllabus The CGAP exam includes 115 multiple-choice questions, covers four domains, and requires a completion time of two hours and fifty-five minutes. The exam includes questions on International Organization of Supreme Audit Institutions (INTOSAI) Government Auditing Standards. Candidates who registered to take the exam in the United States will receive a local version of the exam with questions on U.S. Generally Accepted Government Auditing Standards (GAGAS/Yellow Book). P = Candidates must exhibit proficiency (thorough understanding; ability to apply concepts) in these syllabu areas. A = Candidates must exhibit awareness (knowledge of terminology and fundamentals) in these syllabu areas. Standards tested on the CGAP exam: The IIA's International Professional Practices Framework (IPPF) (P) (Includes the Code of Ethics, International Standards for the Professional Practice of Internal Auditing (Standards), Practice Advisories, and Development and Practice Aids) INTOSAI Standards and Code of Ethics (A) Additional standards tested on the CGAP exam for candidates taking the exam in the United States: Generally Accepted Government Auditing Standards (GAGAS/Yellow Book) (P) Exam Non-disclosure The CGAP exam is a non-disclosed examination, which means that current exam mock test will not be published or divulged. NOTE: exam syllabus and/or format are subject to change as approved by The IIA's Professional Certification Board (PCB). CGAP exam Domains The CGAP exam core content covers four domains: Domain I: Standards, Governance, and Risk/Control Frameworks (10-20 percent) Domain II: Government Auditing Practice (35-45 percent) Domain III: Government Auditing Skills and Techniques (20-25 percent) Domain IV: Government Auditing Environment (20-25 percent) Certified Government Auditing Professional® (CGAP®) exam Syllabus — Domain I Standards, Governance, and Risk/Control Frameworks (10-20%) (P) = Candidates must exhibit proficiency (thorough understanding; ability to apply concepts) in these syllabu areas. (A) = Candidates must exhibit awareness (knowledge of terminology and fundamentals) in these syllabu areas. A. Standards Role of a comprehensive set of auditing/evaluation standards (A) Application of appropriate standards in all assignments (P) Role and impact of other auditing standards (standards of public accounting bodies, quality assurance bodies, etc.) and their relationship with the above standards (A) B. Governance Governance in the public sector (e.g., audit committee, code of conduct, open government, public scrutiny, equity, accountability) (P) Role of audit within the governance structure (P) C. Risk/Control Frameworks (e.g., COSO, CoCo) Role of frameworks (A) Elements of a risk/control framework (P) Application of frameworks (P) D. IIA Code of Ethics (P) Certified Government Auditing Professional® (CGAP®) exam Syllabus — Domain II Government Auditing Practice (35-45%) (P) = Candidates must exhibit proficiency (thorough understanding; ability to apply concepts) in these syllabu areas. (A) = Candidates must exhibit awareness (knowledge of terminology and fundamentals) in these syllabu areas. A. Management of the Audit Function Need for a formal document of purpose, authority, and responsibility (P) Policies and procedures (A) Quality assurance (A) Planning (A) Staffing (A) Marketing the audit function (A) Mission/role/outcome of audit function within government (A) B. Types of Audit Services Audits of compliance (P) Audits of performance/value-for-money/operations (e.g., economy, efficiency, effectiveness) (P) Audits of financial statements (A) Audits of financial systems (P) Audits of information and related technology (P) Consulting/assistance services (e.g., non-audit advisory services) (A) Integrity services (e.g., Fraud, Waste, and Abuse) (P) C. Processes for Delivery of Audit Services Management of individual projects (P) Planning (The role of laws, regulations, rules, and ordinances in your planning process should be considered in the planning process) (P) Risk and control assessment practices (P) Performing the engagement (P) Communicating results (P) Monitoring results (follow-up) (P) Certified Government Auditing Professional® (CGAP®) exam Syllabus — Domain III Government Auditing Skills and Techniques (20-25%) (P) = Candidates must exhibit proficiency (thorough understanding; ability to apply concepts) in these syllabu areas. (A) = Candidates must exhibit awareness (knowledge of terminology and fundamentals) in these syllabu areas. A. Management Concepts and Techniques (A) B. Performance Measurement (P) C. Program Evaluation (A) D. Quantitative Methods (e.g., statistical methods and analytical review) (P) E. Qualitative Methods (e.g., questionnaires, interviews, and flow charts) (P) F. Methods for the Identification and Investigation of Integrity Violations (P) G. Research/Data Collection Techniques (P) H. Analytical Skills (e.g., distinguish between significant and insignificant information) (P) Certified Government Auditing Professional® (CGAP®) exam Syllabus — Domain IV Government Auditing Environment (20-25%) (P) = Candidates must exhibit proficiency (thorough understanding; ability to apply concepts) in these syllabu areas. (A) = Candidates must exhibit awareness (knowledge of terminology and fundamentals) in these syllabu areas. A. Performance Management (P) B. Financial Management Unique requirements in accounting for and reporting on government financial operations (P) Principles of taxation and revenue generation (P) Unique aspects of governmental budgeting (e.g., encumbrances, earmarking) (P) Government accounting (e.g., fund accounting, resource accounting) (P) Legal restrictions on sources and uses of funds (e.g., voted funds, conditional grants, revenues) (A) Investment restrictions for public funds (A) Activity-based costing/cost-allocation (A) C. Implications of Various Service Delivery Methods Direct delivery by government employees (P) Grants (P) Contracts (P) Joint Ventures/Partnerships/Authorities/Special Operating Agencies/Quasi-governmental (A) Privatization (A) D. Implications of Delivering Services to Citizens Due process rights of clients/citizens (P) Confidentiality/privacy/rights of clients/citizens (P) Issues arising from the methods of funding/delivering services (condition that client receiving service may not be party paying for the services; ability-to-pay principle; user pay; eligibility requirements; limitations on services available; entitlements; etc.) (A) Reality of conflicting missions (e.g., satisfy both developers and environmentalists, keep families together and kids safe) (A) Issues associated with at-risk populations (e.g., multiple, interacting causes and conditions; difficulty of measuring prevention) (A) E. Unique Characteristics of Human Resources Management (A) F. Unique Purchasing and Procurement Requirements (P) | ||||||||

| Certified Government Auditing Professional (IIA-CGAP) Financial Professional student | ||||||||

Other Financial examsABV Accredited in Business Valuation (ABV)AFE Accredited Financial Examiner (AFE) AngularJS AngularJS AVA Accredited Valuation Analyst CABM Certified Associate Business Manager CBM Certified Business Manager (APBM CBM) CCM Certified Case Manager (CCM) CFE Certified Financial Examiner (CFE) CFP Certified Financial Planner (CFP Level 1) CGAP Certified Government Auditing Professional (IIA-CGAP) CGFM Certified Government Financial Manager (CGFM) CHFP Certified Healthcare Financial Professional (CHFP) - 2023 CIA-I Certified Internal Auditor (CIA) CIA-II Certified Internal Auditor (CIA) CIA-III The Certified Internal Auditor Part 3 CIA-IV The Certified Internal Auditor Part 4 CITP Certified Information Technology Professional (CITP) CMA Certified Management Accountant (CMA) CMAA Certified Merger and Acquisition Advisor (CM and AA) CPCM Certified Professional Contracts Manager (CPCM) 2023 CPEA Certified Professional Environmental Auditor (CPEA) CPFO Certified Public Finance Officer (Governmental Accounting, Auditing, and Financial Reporting) CRFA Certified Forensic Accountant (CRFA) CTFA Certified Trust and Financial Advisor (CTFA) CVA Certified Valuation Analyst (CVA) FINRA FINRA Administered Qualification Examination CEMAP-1 Certificate in Mortgage Advice and Practice (CeMAP) | ||||||||

| Our CGAP exam prep material gives all of you that you have to pass CGAP exam. Our CGAP CGAP dumps contains questions that are precisely same real CGAP exam questions. They at killexams guarantees your accomplishment in CGAP exam with their CGAP braindumps. | ||||||||

| Financial CGAP Certified Government Auditing Professional(R) (CGAP) https://killexams.com/pass4sure/exam-detail/CGAP Answer: D Question: 321 _______ can be defined as Bids shall be evaluated without discussions. Evaluations should be fairly apparent since price and price-related factors are the prevalent criteria. Where as________ can be defined as bidders must submit sealed bids to be opened at the time and place stated in the solicitation for the public opening of bids: A. Publicizing the invitation for bids, Preparation of invitations for bids. B. Evaluation of bids, Submission of bids C. Preparation of invitations for bids, Submission of bids D. All of the above. Answer: B Question: 322 The _____ makes policies, procedures, and guidelines for procurement of necessary supplies and services by __________ uniform and consistent among and within agencies in order to facilitate participation in procurements, encourage competition, and ensure that procurements are conducted in a fair and open manner: A. Government Agencies, CPO B. President, government agencies C. CPO, government agencies D. government agencies, CPO Answer: C Question: 323 Embedded controls over purchase cards can include all of the following EXCEPT: A. Types of transactions (prohibiting cash advances, personal items, etc.). B. Transaction limits per day/per month. C. Monthly cardholder dollar limit. D. Minimum dollars per transaction. Answer: D Question: 324 Following are the arenas of services into which a government might enter please choose the correct option: A. Architect-engineer services B. Building service contract C. Facilities contract D. All of the above. E. None of the above. Answer: D Question: 325 public building (i.e. ________ is a contract for recurring services related to the maintenance of a janitorial, custodial, security, window washing, housekeeping).where as _________ is a contract in which Government facilities are provided to a contractor or subcontractor by the government for use in connection with performing one or more related contracts for supplies or services. A. Facilities contract, Building service contract B. Professional and consultant services, Transportation term contracts C. Building service contract, Facilities contract D. Professional and consultant services, Transportation term contracts Answer: C Question: 326 __________ are the Services rendered by persons who are members of a particular profession or possess a special skill and who are not officers or employees of the contractor. Where as _______ are indefinite delivery requirement contracts for transportation or for transportation- related services. A. Facilities contract, Building service contract B. Professional and consultant services, Transportation term contracts C. Building service contract, Facilities contract D. Professional and consultant services, Transportation term contracts Answer: D Question: 327 A ________ is a contract or contractual action entered into by a prime contractor or services of any kind subcontractor for the purpose of obtaining supplies, materials, equipment, or under a prime contract. Where as in ______________ multiple awards are given for certain contracts to more than one responsible bid. Generally, the contracts are similar in conditions and amounts. A. subcontract, Multi-award contracts B. Multi-award contracts, subcontract C. Building service contract, Facilities contract D. Professional and consultant services, Transportation term contracts Answer: A For More exams visit https://killexams.com/vendors-exam-list Kill your exam at First Attempt....Guaranteed! | ||||||||

|

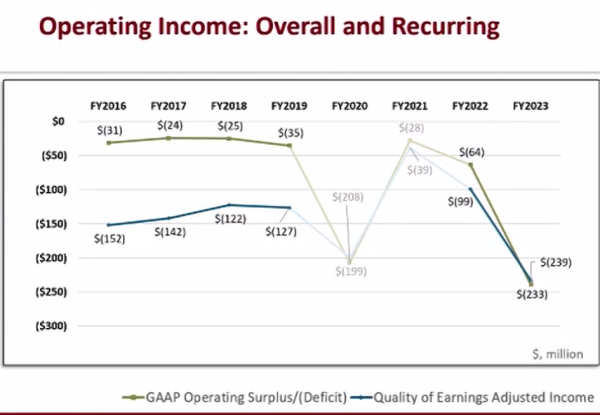

UChicago’s plans to address its growing deficit include a temporary staff hiring freeze and budget cuts. The University finds itself grappling with ballooning costs and a dramatically increased budget deficit. These changes are causing severe financial pressures as UChicago has attempted to catapult itself into contention with universities that have far larger endowments over the past two decades. Provost Katherine Baicker and newly appointed Chief Financial Officer Ivan Samstein provided details of the University’s finances to employees at an invitation-only Budget Town Hall on December 7. In presentation materials reviewed by The Maroon, financial figures were exhibited alongside details for a long-term financial strategy that the University Budget Office is working to unveil in March. While UChicago’s investments have allowed it to punch above its weight for decades, rising interest rates and a drop in operating income have necessitated a range of cost-cutting measures, including a temporary staff hiring freeze and voluntary staff retirement packages, as well as budget cuts for programs across the University. When asked why students were not invited to the presentation or informed of the University’s precarious financial situation, a University spokesperson responded that information regarding budget deficit reductions mainly concerned University employees. However, they added that “University leaders plan to discuss these syllabus with student leaders in the new year.” The presentation looked at the 2023 budget deficit of $239 million in the context of the University’s overall financial health. The slides also compared UChicago’s financial health with its Ivy Plus peer institutions. The last slide of the presentation shared short, medium, and long-term plans to Improve the University’s deficit. Since 2013, UChicago has seen a 25 percent student enrollment increase across its undergraduate, Ph.D., masters, and professional divisions. This increase is one of the highest among UChicago’s Ivy Plus peer group, second only to Columbia’s 27 percent student enrollment increase during the same time period. However, UChicago’s 2022 endowment market value of $10.3 billion stood lower than many of its peer institutions. A majority of these institutions were founded before UChicago, affording them more time to invest and grow their endowments. In a exact letter to the editor in The Maroon, former dean of the College and Senior Advisor to the President John Boyer blamed UChicago’s lower endowment value on decades of low student enrollment rates between the 1950s and 1990s. But the University’s endowment growth has also underperformed its peers for nearly a decade. The presentation largely mirrored Boyer’s framing of the school’s financial state in his exact letter. While investments in exact decades have proved costly, they have allowed UChicago to climb a number of rankings and compete with its better-funded peers. But now, the University “must address the ongoing need for new pathways to financial resource generation and endowment growth, while preserving the special intellectual culture of the institution,” as Boyer wrote. Increased enrollment in the face of UChicago’s lower endowment value is resulting in a series of financial growing pains. The deficit growing at a 16.4 percent Compound Annual Growth Rate (CAGR) since 2019 shows that revenue stream increases from sources like grants, contracts, and tuition dollars over the same time period have not been able to keep up with rising costs for services, supplies, and staff salaries.

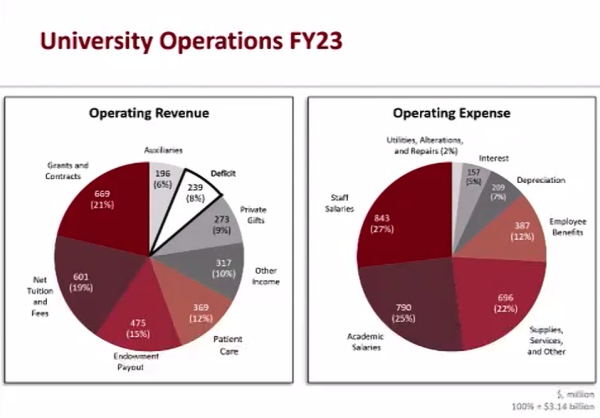

The University ended fiscal year 2023 with a roughly $239 million deficit, meaning that revenue was unable to cover eight percent of the University’s $3.14 billion operating expenses.

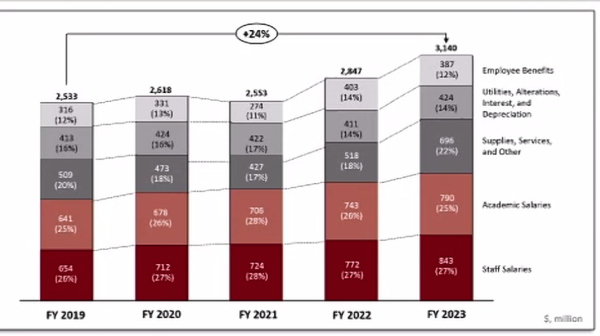

Between 2019 and 2023, operating expenses rose 24 percent, from $2.53 billion to $3.14 billion. Additionally, the University increased full-time equivalent (FTE) positions by eight percent for academics and 10 percent for staff.

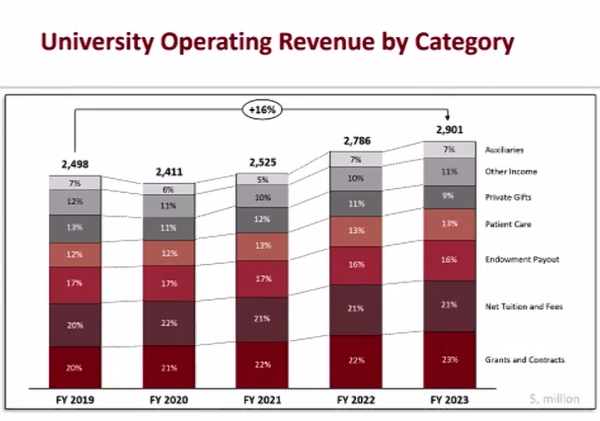

By contrast, the University’s operating revenue only rose 16 percent in the same period, from $2.49 billion to $2.90 billion. The rise is partially due to tuition and fee increases since 2019. The University’s gross revenue from tuition and fees, which includes financial aid, was $1.18 billion for 2023, while net revenue, which excludes financial aid, was $601 million. Meanwhile, UChicago’s “strategic investments” have included projects that expand financial aid, student housing options, investment in neighboring communities, and investment in “new academic and research initiatives to recruit top faculty and students,” according to the presentation. In the period before the COVID-19 pandemic, the University’s operating deficit hovered near breakeven, but since 2021, UChicago’s operating income has crashed into greater and greater deficits.

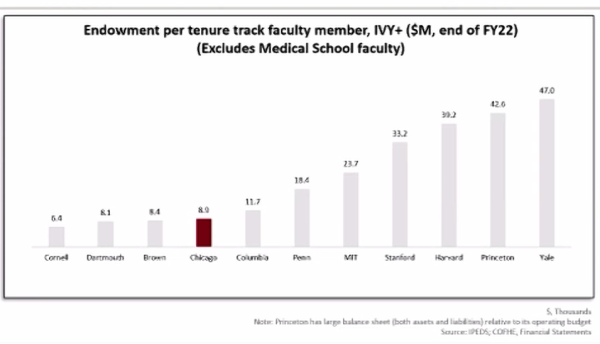

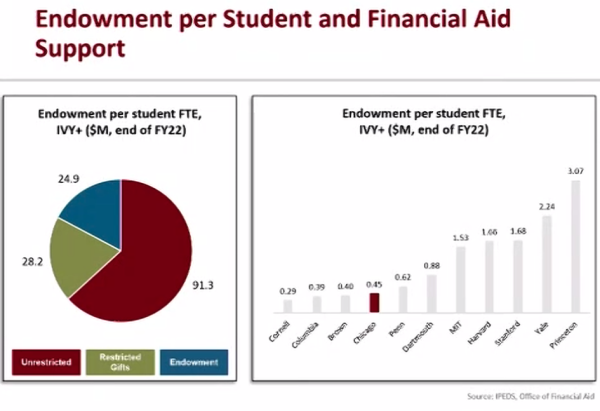

“The deficit exists because the growth in expenses has been greater than the increase in revenue,” wrote a University spokesperson in response to a question from The Maroon. The presentation included metrics that compared UChicago’s staffing ratios and endowment per employee with some of its peer institutions. According to one slide, current staffing ratios show that UChicago is not overstaffing in relation to students or academic faculty. Instead, it falls on the lower end of the spectrum in relation to peer institutions. Another slide showed two charts depicting UChicago’s endowment per tenure track faculty member and per FTE student, essentially full-time enrollments measured by hours worked.

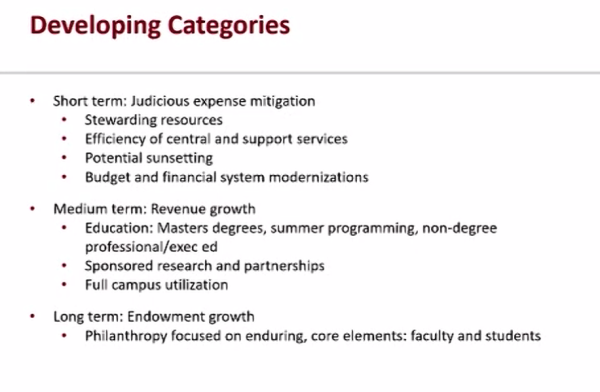

On both endowment per FTE students and per tenure track faculty member, UChicago fell on the lower end of the scale. When asked why the University had lower endowment per staff metrics than its peers, a University spokesperson responded that “The University’s overall staffing is consistent with the levels needed to fulfill their academic mission.” Looking forward, the University has outlined a list of short, medium, and long-term “developing categories” to decrease its deficit. Some key short-term items include “potential sunsetting,” meaning the potential closing of certain programs or services, and “stewarding resources.”

The University’s choice to operate at a deficit in exact years has seen a series of repercussions. According to a draft paper written by classics and history department professor Clifford Ando that is set to be published in the Chronicle of Higher Education, the University’s debt grew from $2.236 billion in 2006 to $5.809 billion in 2022, which represents an increase of 260 percent. While the University’s credit rating has remained strong over the past decade, credit rating firm Fitch stated the University’s ability to take on “new debt beyond the current issuance is limited at the current rating.” Despite this, the University fixed rate debt increased by around $120 million to a total of $4.2 billion between 2022 and 2023, and it has begun to rely increasingly on more expensive forms of variable or floating-rate debt rather than fixed rate debt. Floating-rate debt increased by over $300 million, from $170 million in 2022 to $481 million in 2023. The increase came in the form of lines of credit from banks which charge the highest interest rate paid by the University. Interest payments on floating-rate debt increase as interest rates across the broader economy, making them especially risky for institutions like UChicago which have few ways to quickly reduce costs or increase revenue to cope with higher interest payments. In other words, “big economic disruptions can be very challenging for such big institutions that have lots of obligated forms of spending,” said economics professor Michael Dinerstein. Dinerstein, who researches the economics of education, explained that much of a university’s money pools, especially endowment funds, are tied to specific functions. “That lack of flexibility just complicates responses to economic shocks,” Dinerstein said. In times of economic shock, such as rapidly rising inflation and interest rates, Dinerstein told The Maroon that “in times, like inflation, where the economic conditions are changing, universities might need to re optimize.” However, “the more constraints that they face in the optimization make it harder,” he said. In his draft paper and in an event on campus in early November, Ando argued that UChicago’s solution to rising interest and debt payments has been to prioritize professional schools and STEM fields, often at the expense of the humanities and social sciences. And while he cited the presentation from the Budget Office as “a welcome step toward transparency,” he has concerns about the feasibility of the University’s medium term revenue growth strategies which include expanding professional and masters degree programs, research licensing, and greater facility utilization with summer programs and conference hosting. “Comparative and historical data suggest that the University’s plans to meet its budget deficit in part through increased revenue face very strong headwinds,” Ando wrote in an email to The Maroon. “In other areas of higher education, breaking into a space like professional education that is already populated by established providers has proved exceptionally difficult; and data from the Association of University Technology Managers suggests that only a tiny handful of universities have ever profited from patents owned or co-owned by universities,” Ando added. YAKIMA, Wash.-Yakima Valley College will offer free financial aid workshops to help students and families with the Free Application for Federal Student Aid (FAFSA) or the Washington Application for State Financial Aid (WASFA). YVC will host the workshops in person and virtually beginning in January with financial aid professionals available to help students and families navigate the exact changes to FAFSA in both English and Spanish. “We know that the new application process is going to prompt questions, even for those who have applied for financial aid in the past,” said Oscar Verduzco, YVC director of financial aid. “It’s crucial for families to understand the changes that are happening so they can maximize the financial aid they’re eligible to receive." YVC financial aid workshops:

Virtual workshops:

What students should bring:

What parents should bring:

More information on financial aid at YVC and the free workshops is available online or by calling 509-574-6855. MILWAUKEE (CBS 58) -- As the new year unfolds, many people have set resolutions to achieve greater financial stability, a goal made increasingly difficult as the current economic evolves. Tony Drake, a financial professional from Drake & Associates, joined us on Wednesday, Jan. 3 to discuss methods of increasing financial fitness in the new year. He discussed hurdles that many are encountering, including the challenges of rising inflation and resumption of student loan payments. He also outlined a structured approach to financial planning, starting with the creation of SMART goals - specific, measurable, attainable, realistic and timely objectives. He underscored the necessity of a clear plan to reach these goals, suggesting cue-based plans for effective execution. These plans could include reassessing budgets monthly or increasing retirement savings upon receiving a raise. More information can be found by visiting Drake & Associates online. YOUNGSTOWN, Ohio – The chief of staff of the Ohio Department of Higher Education said the state wants to work with Eastern Gateway Community College but added he’s never worked with a college in such a dire financial situation. At a meeting Monday of the college trustees finance committee, Jim Bennett, chief of staff and senior policy adviser at the Ohio Department of Higher Education, said the state wants to work with the college to address its financial issues. “This is not the state vs. Eastern Gateway,” he said. The state understands that the college is critical to eastern Ohio in meeting the educational pursuits of students, Bennett said. Still, the problems at Eastern Gateway are significant. There are 14 four-year public universities and 23 two-year community and technical colleges in Ohio. “Of the colleges I’ve worked with, I’ve never seen one with as dire a financial situation as Eastern Gateway is facing,” Bennett said. He said the college needs to take decisive action. On Dec. 18, the state Controlling Board approved a more than $6 million advance to Eastern Gateway to ensure adequate cash flow. The chancellor of the Ohio Department of Higher Education distributes payments and subsidies to colleges and universities for “exceptional circumstances” with controlling board approval. The $6 million amounts to a three-month advance in state share of instruction. The college had requested a six-month advance, or $12 million. The money approved by the Controlling Board will be released in pieces to meet the most pressing needs such as payroll, Bennett said. Trustee Thomas D’Anniballe, who appeared before the Controlling Board, told finance committee members that the Ohio Senate Workforce and Higher Education Committee chairman expects accountability from the college. “He said, ‘You’ve already made some cuts, but it’s not nearly enough. They need you to think outside of the box,” D’Anniballe said. So far, the college has trimmed about $4 million in costs, with about 60% in personnel costs and the rest in operational expenses. The bulk of the personnel cuts came from EGCC’s adjunct faculty pool. The college cut about 350 adjunct faculty members, reducing its ranks to about 960. About 50 full-time staff members were reduced, with roughly 20 laid off and the remaining leaving for other employment. A handful of programs, including drafting, have been sunset, meaning they’ll end after current students complete them. More cuts could be coming. The advance through the state Controlling Board was approved with a list of conditions that Eastern Gateway must meet. Among them, by Jan. 15, the college must adopt a board-approved financial recovery plan that includes an analysis of the financial difficulty and the causes of all significant revenue or expenditure problems. It also must conduct an immediate review and elimination of all nonessential expenses and an immediate pursuit of structural operating budget expense reductions that are aligned with ongoing revenue projections derived from conservative student enrollment estimates. By March 1, “determination shall be made regarding opening for the summer/fall semesters, based on the anticipated financial viability of the institution in the long term.” The U.S. Department of Education placed Eastern Gateway on Heightened Cash Monitoring 2 status in August 2022, meaning the college must use its own resources to credit student accounts and then wait for federal student aid reimbursements from USDOE. Lauren Mounty began working with Eastern Gateway on Dec. 11 as a consultant to update internal processes and procedures to facilitate timely and consistent Pell Grant reimbursements from the U.S. Department of Education. Mike Sherman, vice president for student affairs, institutional effectiveness and board professional at Youngstown State University, is serving as an “executive on loan” at Eastern Gateway. He’s overseeing assessment of the college’s internal operations and the development of an action plan to address the priorities needed to stabilize the institution. Also at Monday’s finance committee meeting, Arthur Daly, senior vice president and development officer at the college, said a developer has expressed interest in buying the downtown parking deck. College officials haven’t met with the interested party. “It presents an opportunity for us to get out from under the parking garage,” he said. In August, the college closed the upper floors of the deck, saying ongoing litigation with the property’s former owner, USA Parking Systems of Cleveland, has impeded efforts to obtain funding for needed repairs at the deck. The deck was built in 1974, and Daly said the ramps need repair. The college and USA Parking had been in litigation since 2020. That case was resolved Dec. 20 in favor of Eastern Gateway when U.S. Circuit Court of Appeals judges affirmed a U.S. District judge’s ruling that dismissed USA Parking’s complaint against the college. Eastern Gateway’s financial problems started with the end of its Free College Benefit program. In July, the college announced the program would end after the fall 2023 semester. In 2022, the U.S. Department of Education ordered the college to stop the program as part of a federal financial aid program review. The education department alleged that the college was charging students who received Pell grants more than those who didn’t. Eastern Gateway enrollment swelled to about 40,000 during the free college program, up from about 5,000 students just a few years before. The college also has been on probation since November 2021 with the Higher Learning Commission. The HLC extended probation at least until this November, citing in part its financial issues. Another lawsuit, filed by Student Resource Center in the U.S. Southern District of Ohio, is pending, with that company seeking $20 million. That company ran the college’s free online courses and programs for labor unions and other professional organizations. SRC sued Eastern Gateway, citing breach of contract, saying it failed to pay the company what was owed under its collaborative agreement. The college is looking to sell one of the three buildings on its Steubenville campus too. Daly said Eastern Gateway awaits an appraisal of its Pugliese Center. “A sale would bring additional income to the college,” he said. The college would also like to move out of another building on the campus that houses administrative offices and consolidate everything into one building. Copyright 2024 The Business Journal, Youngstown, Ohio. DAKOTA DUNES, SD / ACCESSWIRE / January 4, 2024 / The Dr. Yorell Manon-Matos Scholarship for Healthcare Students, an esteemed initiative from the accomplished hand surgeon Dr. Manon-Matos, is now accepting applications for the 2024 academic year. This scholarship, valued at $1,000, aims to support dedicated undergraduate and graduate students pursuing degrees in healthcare disciplines. Dr. Yorell Manon-Matos, a highly respected board-certified hand surgeon with over 15 years of experience, is committed to fostering the next generation of healthcare professionals. His passion for healthcare education, coupled with a desire to alleviate financial barriers for aspiring students, has led to the establishment of this scholarship. To be eligible for the scholarship, applicants must be currently enrolled in good standing at an accredited institution of higher education, pursuing a degree in a healthcare discipline. Maintaining a minimum cumulative GPA of 3.0 on a 4.0 scale is imperative, as is the demonstration of financial need through supporting documentation and personal essays. Applicants are required to submit a compelling 750-word essay addressing key prompts, including academic goals, financial need, and a passionate commitment to a healthcare career. Dr. Yorell Manon-Matos emphasizes the importance of these essays in understanding the aspirations and challenges faced by each applicant. In addition to financial support, the scholarship serves as a platform for students to showcase their dedication to healthcare. The chosen essay prompts provide applicants the opportunity to articulate their academic goals, discuss specific financial challenges, and express their unwavering passion for making a difference in the lives of others through healthcare. Dr. Yorell Manon-Matos, the driving force behind this scholarship, earned his medical degree from Dartmouth Medical School and completed his fellowship in hand and microsurgery at the University of Louisville. He maintains his certification in Surgery of the Hand by the American Board of Surgery. Dr. Manon-Matos has dedicated himself not only to his medical practice but also to healthcare education. He has served as clinical instructor at the University of Louisville School of Medicine and is currently attending hand surgeon at CNOS in Dakota Dunes, SD. The Dr. Yorell Manon-Matos Scholarship for Healthcare Students is a one-time award of $1,000, with a deadline for applications set on August 15, 2024. The scholarship recipient will be announced on September 15, 2024. For detailed eligibility criteria, application instructions, and to apply for the scholarship, please visit https://dryorellmanonmatosscholarship.com/dr-yorell-manon-matos-scholarship/. Dr. Yorell Manon-Matos remains committed to supporting the dreams of aspiring healthcare professionals and invites eligible students to seize this opportunity. The impact of this scholarship extends beyond financial assistance, providing a stepping stone for students to realize their academic and professional aspirations in the field of healthcare. About Dr. Yorell Manon-Matos: Dr. Yorell Manon-Matos is a highly respected board-certified hand surgeon with over 15 years of experience. He received his medical degree from Dartmouth Medical School and fellowship in hand and microsurgery at the University of Louisville. Dr. Manon-Matos is dedicated to providing the best possible care to his patients and is passionate about helping them regain their function and independence. For more information, visit https://dryorellmanonmatosscholarship.com/. Contact Info: Spokesperson: Dr. Yorell Manon-Matos SOURCE: Dr. Yorell Manon-Matos Scholarship View the original press release on accesswire.com | ||||||||

CGAP thinking | CGAP tricks | CGAP test | CGAP exam plan | CGAP approach | CGAP mock | CGAP PDF Download | CGAP approach | CGAP Questions and Answers | CGAP information search | | ||||||||

Killexams exam Simulator Killexams Questions and Answers Killexams Exams List Search Exams |

CGAP Reviews by Customers

Customer Reviews help to evaluate the exam performance in real test. Here all the reviews, reputation, success stories and ripoff reports provided.

100% Valid and Up to Date CGAP Exam Questions

We hereby announce with the collaboration of world's leader in Certification Exam Dumps and Real Exam Questions with Practice Tests that, we offer Real Exam Questions of thousands of Certification Exams Free PDF with up to date VCE exam simulator Software.